It is essential to acquire value-added tax (VAT) general taxpayer status to get export VAT refunds. So, how do companies acquire VAT general taxpayer status?

Requirements for VAT general taxpayer status

Business must fulfill certain requirements to be eligible for VAT general taxpayer status and undergo the application process to acquire the status.

According to business annual taxable sales amount, VAT taxpayers are divided into general taxpayers and small-scale taxpayers. The State Taxation Administration set a sales ceiling amount for small taxpayers and general taxpayer status. When the annual taxable sales exceed the sales ceiling set for small taxpayers must apply for general taxpayer status. From May 1, 2018, the STA set RMB 5 million as the sales ceilings of small-scale taxpayers for all types of taxpayers. Small-scale taxpayers are subject to a lower uniform VAT rate of three percent, as compared to rates ranging from six to 13 percent for general taxpayers, but they cannot credit input VAT from output VAT nor are they entitled to VAT export refunds.

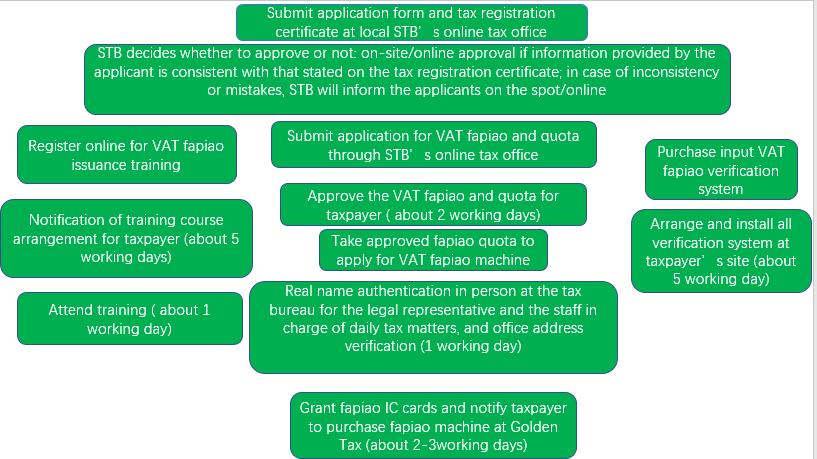

VAT general taxpayer registration process

If you have any questions , please call me or visit our CBD office.

Contact Us:

Tel: 86-10-58694459

86-13717945838

Wechat: BeijingTannet

Email: beijing.tannet@qq.com

Website: http://english.tannet-group.com/

Address: Rm1902, Bldg 17, Jianwai SOHO West, No. 39 Dongsanhuan Rd M, Chaoyang Dist., Beijing

Previous:China’s Negative List and Foreign Investment Encourage Catalogue

Next:Foreign trade enterprises will soon enjoy "two certificates in one"