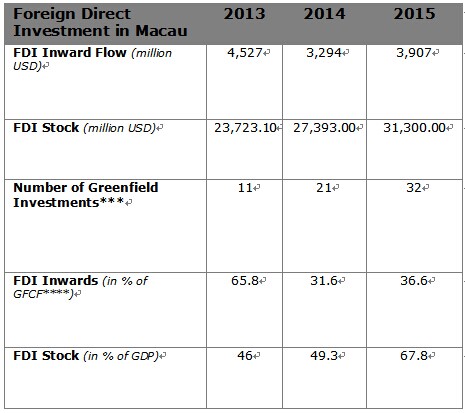

Macau is a territory which has benefited from substantial FDI inflows in recent years, even though there have been periods of downturn, such as in 2009 and 2011. FDI reached over USD 3 billion in 2014. The recovery of the American market and the many infrastructure projects currently under way (new casinos, hotels, an airport extension, bridges, etc.) should support FDI flux, despite the negative effects of the Chinese anti-corruption policy. The liberalised economy of Macao, its free port status, its political stability and its strategic geographical position in the heart of a dynamic zone, offer a large number of attractive features to foreign investors.

a. Foreign Direct Investment

Foreign investments are mainly concentrated in the gambling and banking sectors, as well as in the tourism sector (hotel industry). The main investing countries are Mainland China, Hong Kong and the United States.

b. Taxation

In Macau, all nature of business was not subjected to VAT or consumption tax.

For company tax, the tax rate is in between 0% to 12%

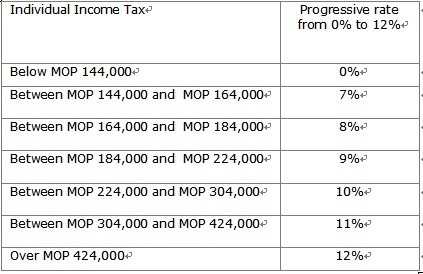

For individual income tax:

c. Investment Incentives

For foreign investment projects that promote economic diversification, contribute to promote exports to new markets, add value to the economy and contribute to technological modernization, there are fiscal incentives available.

Major tax incentives available to investors include:

- Total exemption of property tax granted to real estate purchases for industrial purposes;

- Total exemption of up to five years in Macau, and ten years on Taipa and Coloane, for new real estate rented for industrial purposes;

- Fifty percent reduction in complementary tax.

There are no withholding taxes on interest, royalties or any other source of income paid to non-residents, save for dividends to be distributed to non-residents.

Imported new vehicles to be used by hotels and travel agencies are exempted from vehicle tax, at the request of the local purchaser.

There are also financial incentives as well as refundable and non-refundable subsidies for investment projects, which are granted on a case-by-case basis and considered mainly for projects that address the diversification of the economy, environmental protection, technology innovation, new products and anti-pollution equipment.

Contact Us

If you have further enquire, please do not hesitate to contact Tannet at anytime, anywhere by simply visiting Tannet’s website english.tannet-group.com, or calling Hong Kong hotline at 852-27826888 or China hotline at 86-755-82143422, or emailing to tannet-solution@hotmail.com.

Previous:UK Trademark Registration

Next:Macau Company Registration