China’s five year tax rule for foreigners is expected to be canceled. On June 19, 2018, China’s Ministry of Finance has unveiled a series of Draft Amendments to its individual income tax (IIT) Laws. These proposed changes are aimed at easing the tax burden for lower-income earners in particular, while taking a tougher stance on both foreigner workers and high-income earners.

New IIT System for Foreigners

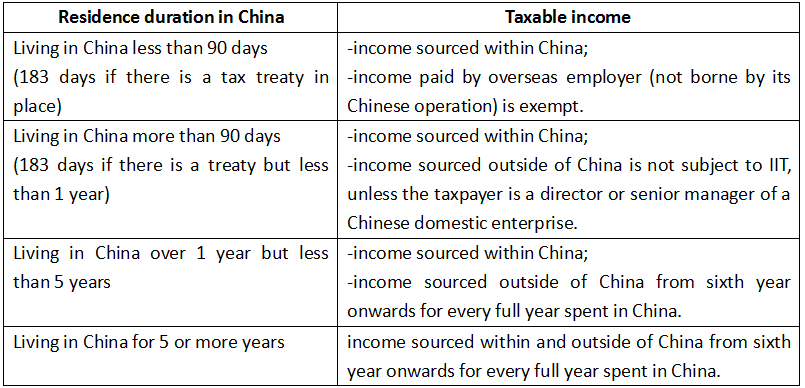

Foreigners living and working in China will now be subject to the 183-day test, a rule that draws upon recognized international practices. This test deems a foreign individual who resides in China for 183 days or more in a year a ‘resident’ and subjects them to Chinese tax on their worldwide income.

This new 183-day-test will replace the previous five-year-rule under which a foreign individual will be subject to Chinese tax on their worldwide income if they live in China for more than five years.

1. Resident taxpayers

Foreign individuals reside in China ≥ 183 days (within a tax year);

2. Non-resident taxpayers

Foreign individuals reside in China < 183 days (within a tax year).

Current Taxable Income for Foreign Individuals

Once the Draft Amendments come into effect, this Five Year Tax Rule is no longer valid. Under the new system, a foreign individual who resides in China for 183 days or more in a year a ‘resident’ and subjects them to Chinese tax on their worldwide income.

Calculation of an individual’s tax payable are:

Monthly taxable income = Monthly income - RMB 4,800 - Allowances

Tax payable = Monthly taxable income * Applicable tax rate - Quick calculation deduction

Note:

1. RMB 4,800 is the standard deduction for foreigners;

2. The current deductible allowances applicable are no longer available in the new tax system.

Contact Us

If you have further inquires, please do not hesitate to contact Tannet at anytime, anywhere by simply visiting Tannet’s website english.tannet-group.com, or calling Hong Kong hotline at 852-27826888 or China hotline at 86-755-82143422, or emailing to tannet-solution@hotmail.com. You are also welcome to visit our office situated in 16/F, Taiyangdao Bldg 2020, Dongmen Rd South, Luohu, Shenzhen, China.

Previous:Cybersecurity Law in China

Next:Preferential Policy in Qingdao